RAJJ Investment Properties, Inc.

340 Adam St, Fayetteville, NC 28301, USA- Common Stock

- 36 - 60 months

- 12-15%

User Login!

*Minimum Investment: $1,000

The Terms

Security Type

Debt

Investment Duration

36 - 60 months

Return on Investment

12-15%

Payout Schedule

January 31, 2027

Exit Strategy

Refinance

About Us

RAJJ is a growth-driven real estate investment firm focused on identifying high-potential opportunities in new construction and property rehabilitation.

Why Invest

The Investment Opportunity

RAJJ Investment Properties is launching a $5 million Regulation Crowdfunding raise to fund two high-impact, socially responsible real estate projects.

Adam Street Apartments Expansion

RAJJ Investment Properties, Inc., led by U.S. Marine Corps veteran Jerome Nyjuan Bell, Sr., is raising $5 million to expand the Adam Street Apartments in downtown Fayetteville, NC. Building on the success of the fully leased 16-unit complex developed in 2023, the project will refinance $3.23 million in debt, add a new quadraplex with four luxury three-bedroom units, and cover construction and contingency costs. With strong demand, a waiting list, and plans for recreational space, the expansion supports community revitalization and economic growth. As the first development of its kind by a local Black-owned firm, it is poised to enhance property values, increase downtown residency, and contribute meaningfully to Fayetteville’s transformation.

American Eagle Inn Redevelopment

RAJJ Investment Properties is raising capital to acquire and convert the 48-room American Eagle Inn in Fayetteville, NC, into long-term affordable housing. Located directly behind the fully occupied Adam Street Apartments, this project supports community growth by transforming underutilized hospitality space into quality residential units. Funds will cover the $1.5M acquisition, $2M in renovations, $1M for furnishings, and $500K for marketing and lease-up. Just 5.4 miles from the airport and near major attractions, the property’s location and existing infrastructure make it ideal for adaptive reuse—offering investors both strong potential returns and meaningful social impact.

Why Invest in Fayetteville?

- Population Growth & Military Presence: Home to Fort Liberty (formerly Fort Bragg), Fayetteville benefits from constant demand for rentals due to military personnel, contractors, and transient workers.

- Housing Gap: The city faces a shortage of affordable and one-bedroom units.

- Smart Strategy: New construction is expensive. Hotel-to-housing conversion offers faster ROI and lower cost-per-unit.

About the Sponsor

Jerome Nyjuan Bell, Sr.

CEO

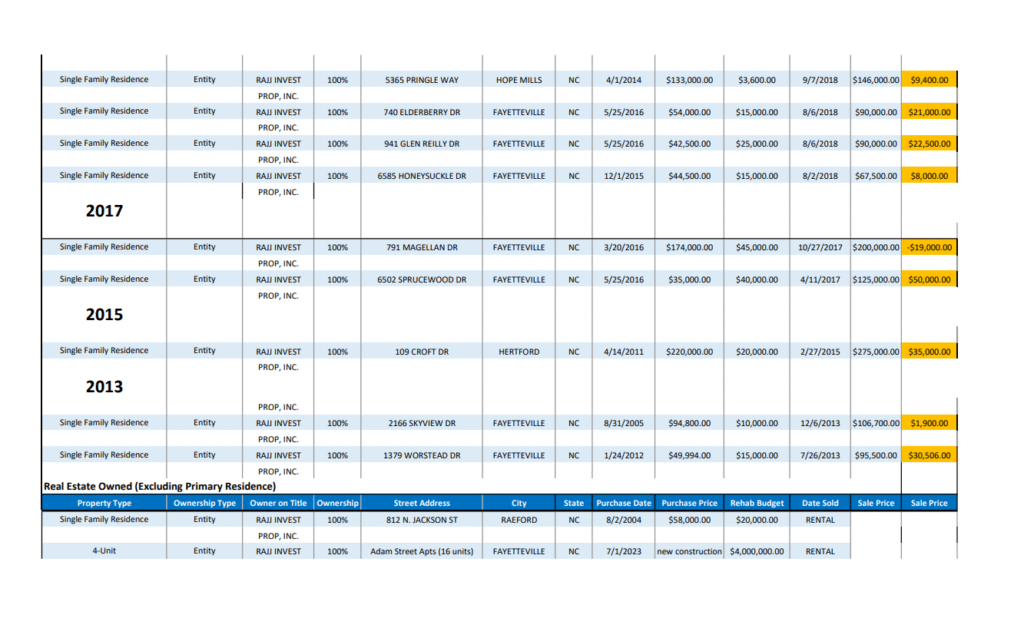

RAJJ Investment Properties, Inc., led by U.S. Marine Corps veteran Jerome Nyjuan Bell, Sr., is a mission-driven real estate investment company based in Fayetteville, North Carolina. With over 20 years of real estate experience, Jerome has successfully flipped, built, and rented dozens of properties—transforming neglected neighborhoods into vibrant, sustainable communities. Backed by a strong portfolio, RAJJ continues to operate profitably even during economic downturns, as evidenced by consistently solid tax returns and cash-flowing assets.

Jerome holds a Bachelor’s degree from Florida A&M University and an MBA from Averett University. He is also the founder of ExpressTax Professionals, a firm that has served Fayetteville residents for over a decade.

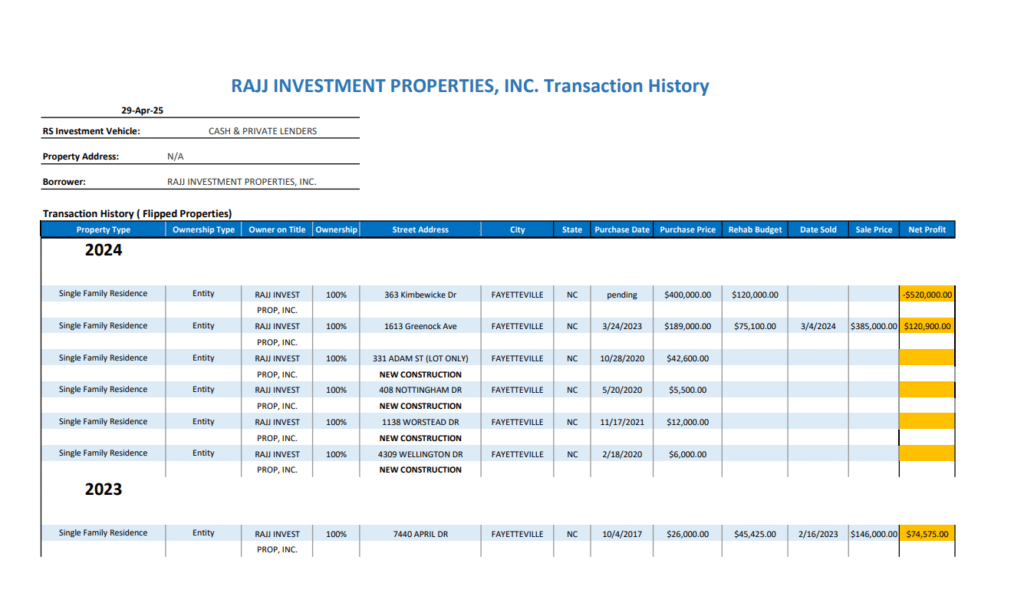

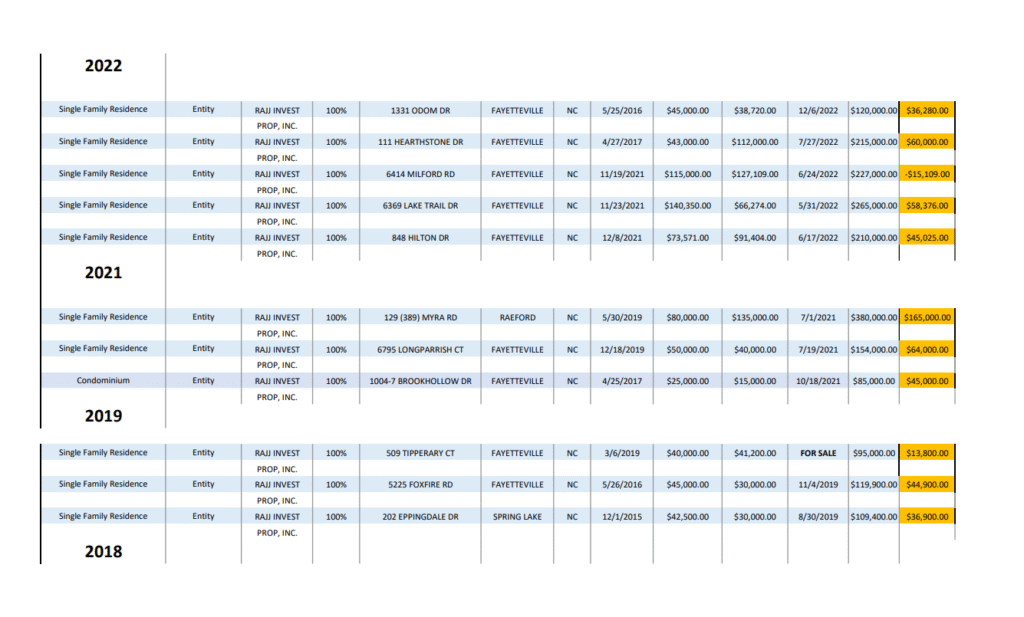

Portfolio Performance

RAJJ Investment Properties offers a compelling investment opportunity backed by strong financial performance and operational efficiency. In 2023, the company generated over $1.6 million in gross income, and 2024 is already showing solid momentum with more than $1.0 million in revenue year-to-date, according to the latest tax filings. With a lean structure that leverages independent contractors to maintain cost control and avoid unnecessary overhead, RAJJ has completed over 20 successful real estate transactions, earning profits between $9,000 and $165,000 per project—ranging from custom home builds to distressed property rehabs and land development. As a veteran-owned and operated business, RAJJ is committed to full transparency, community-centered growth, and strong rental income supported by a solid asset base. Investors can feel confident partnering with a team that prioritizes integrity, impact, and sustainable returns.

Our Strategy

Join the Mission—Build Wealth with Purpose

This is more than an investment—it’s an opportunity to create impact. By joining RAJJ Investment Properties, you’re contributing to the revitalization of Fayetteville while earning potential returns from two high-demand rental assets.

How Investing Works

Cancel anytime before 48 hours before the offering end date.

The Disclosures

Any investment has risks and potential loss of funds. RealRise Capital does not guarantee specific gains from any particular investment. You are solely responsible for deciding whether an investment is appropriate based on your personal investment objectives, financial circumstances, and risk tolerance. By engaging in crowdfunding activities, the issuer acknowledges and agrees that it is permitted to provide compensation to third parties for the promotion of its crowdfunding offerings through communication channels facilitated by RealRise Capital. However, this permission is contingent upon the issuer taking diligent and reasonable steps to guarantee that any promoter involved explicitly discloses the nature and extent of the compensation received in conjunction with each communication made.

RealRise Capital charges fees in connection with the sale of securities on our platform. RealRise Capital will charge Issuers who complete their capital raise a range of compensation types (e.g., flat fee, platform fee, and/or equity fee in the form of commission). The flat and platform fee will be paid when the successfully funded campaign ends. Any securities paid to RealRise Capital, if any, will be of the same class and have the same terms, conditions, and rights as the securities being offered and sold by the Issuer on our platform. All fees paid to Secure Living in connection with the offering and sale of securities are nonrefundable unless in its sole discretion determines that a refund is appropriate.

Hello,

I was hoping you could clarify a couple details regarding this opportunity.

1. The company is a corporation per page 1 but on page 29 it says it’s an LLC and the offering is Common Shares, however, I saw references to member equity, Class A Member Securities and capital contributions. Is the company treated as a pass through entity similar to Limited Partnerships or Managed LLCs or is it a Corporation and shares are being offered as if I were to buy shares of Apple through my brokerage account. I ask because there are significantly different tax implications depending on how the company is setup/treated. Just to clarify not asking for tax advice just clarity on how the company is set up based on this investment. Per the offering statement you’re a tax professional also so let me be more specific, is it a K-1 or a 1099?

2. Are we investing in specific projects and if/when those projects are completed and sold we get our investment back plus whatever gains/losses attributed to the investment and then we are out or are we investing in the company and will receive gains/losses to all future properties? I feel like that may also go back to my first question on K-1 or 1099, are gains and losses passed through. I ask because there was mention of How the managers exercise of rights could impact investors followed by a comment of if/when investors will get their money back. Essentially is this a term investment tied to the particular properties or is this an actual equity stake in the company?

3. I don’t believe I saw anything that speaks to the ~$130k reduction YoY net income between 2023 and 2024. Can you speak to the cause of that?

Good afternoon Brandon_lev,

First of all, thank you for such insightful questions. Here are my responses:

1. The company is a C-Corporation and you are being issued common shares, and will receive a Form 1099.

2. You will be investing in a specific project, not the long-term viability of the corporation, so no equity is being offered.

3. The (-$130k) reduction was due to less homes being sold than the previous year. In this arena of higher interest rates, and higher priced homes, we are experiencing less showings, less offers and homes are taking longer to sell.